Real News Vs. Fake News

Fake News

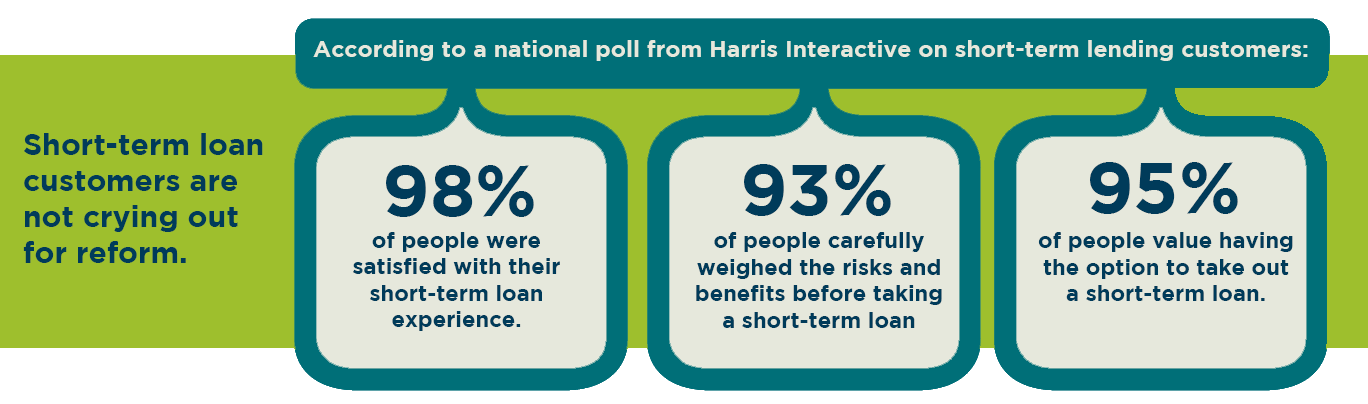

Millions of Texas short-term lending consumers are demanding short-term lending reform.

Real News

Short-term lending consumers value and appreciate the flexibility and choice the industry provides in case of financial emergency.

Fake News

The average short-term loan costs are more than 400 percent.

Real News

These loans are designed to be less than one year and in many cases, less than six months.

Fake News

Short-term lenders attempt to "trap" people in a cycle of debt that they are unable to escape.

Real News

Short-term lending associations often have a series of best practices designed to work with people that are having difficulty paying off their loans.

Fake News

Short-term lenders are generating massive profits off people in financial emergencies.

Real News

Contrary to popular belief, Credit Access Businesses and short-term credit providers generally make about one percent of revenues when you factor in default rates.

Fake News

Eliminating private sector, short-term credit options will eliminate demand and save underbanked Texans millions of dollars in costs.

Real News

Plans like this not only limit access to credit, but they also drive up the cost of loans for those who already have few credit options.

Fake News

Activists claim that community and charitable loan programs can fill the consumer demand for short-term credit in Texas.

Real News

Community and charitable lending programs, while encouraging and laudable ideas, can't come close to meeting consumer demand.

This is a manufactured crisis created by politicians, liberal activists, and the mainstream media intent on eliminating private sector credit options for underbanked Texans.

This is a manufactured crisis created by politicians, liberal activists, and the mainstream media intent on eliminating private sector credit options for underbanked Texans.